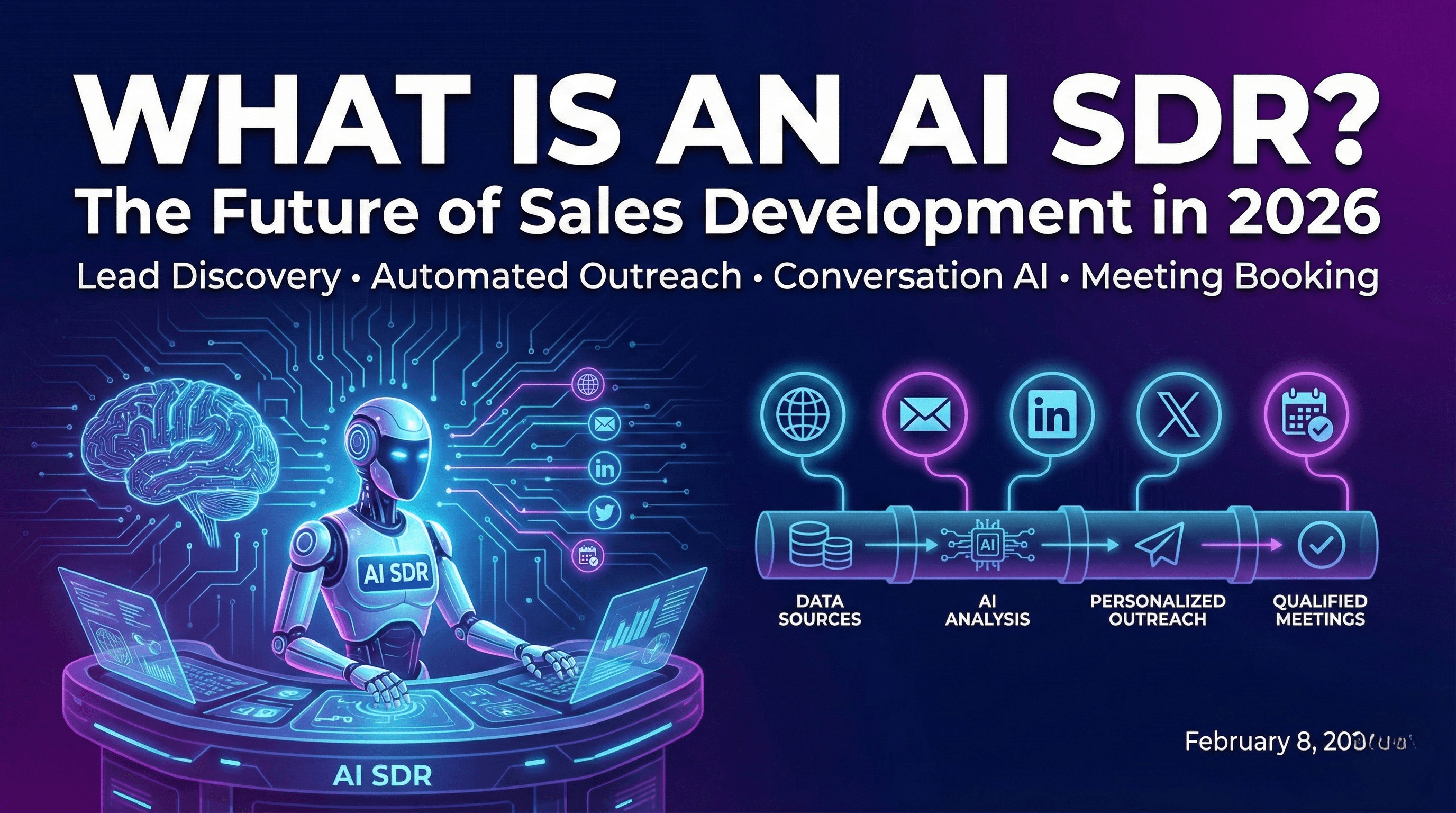

Signal-Driven Outbound: Why Timing Beats Messaging in B2B Sales

Signal-driven outbound uses real-time buyer intent signals on LinkedIn and X to time sales outreach perfectly. Learn the 3 signal types, how to detect them, comparison frameworks, and ROI benchmarks for 2026.

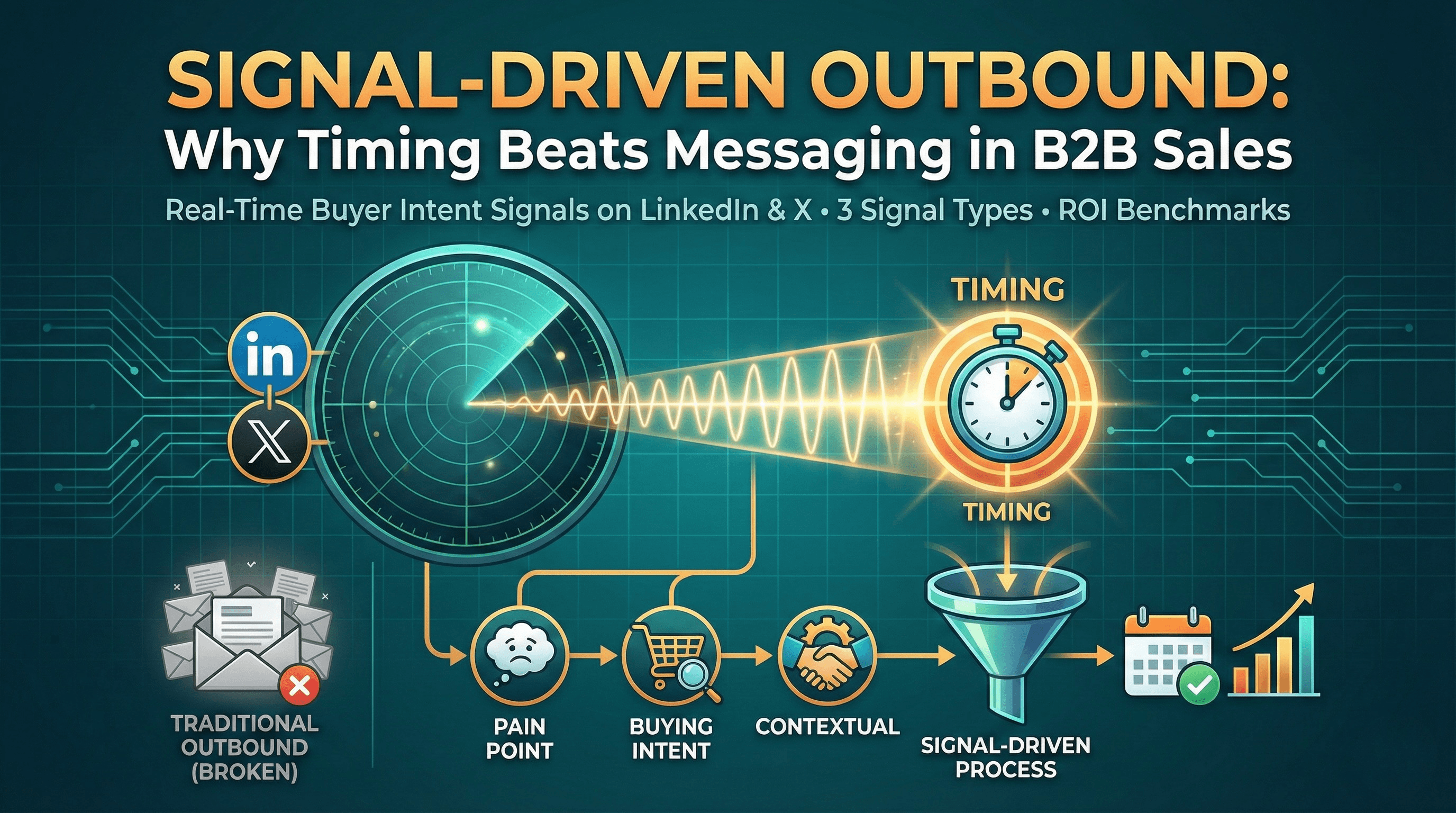

Your outreach message is probably fine. The reason it's not working is because you're sending it to the wrong person at the wrong time.

This is the uncomfortable truth about outbound in 2026: the message was never the problem. Timing is. Research from Gartner shows that B2B buyers spend only 17% of the purchase journey meeting with potential suppliers. When buyers are comparing multiple vendors — typically three or four — the time spent with any single sales rep drops to just 5-6%. That means for over 94% of the buying process, your prospect isn't interested in hearing from you.

Signal-driven outbound flips this model. Instead of blasting prospects and hoping for the best, you detect when someone is actively showing signs of needing your solution and reach out at that exact moment. Forrester's 2025 research found that businesses using intent data see 36% improved conversion rates from outbound campaigns and 29% lower acquisition costs. The difference isn't incremental. It's a complete transformation of how outbound works.

Table of Contents

- What is Signal-Driven Outbound?

- Why Traditional Outbound is Broken

- The Science of Timing in B2B Sales

- What Are Buyer Intent Signals?

- Where Buyer Signals Appear on LinkedIn and X

- How Signal-Driven Outbound Works in Practice

- Signal-Driven vs. List-Based Outbound: A Comparison

- How to Build a Signal-Driven Outbound System

- Common Mistakes When Moving to Signal-Driven Outbound

- Key Takeaways

- FAQ

What is Signal-Driven Outbound?

Signal-driven outbound is a B2B sales methodology where outreach is triggered by real-time buyer intent signals — observable behaviors that indicate a prospect is actively moving toward a purchase decision — rather than static lists or fixed cadences. It is also referred to as signal-based selling, warm outbound, or intent-based outreach.

Instead of deciding who to contact based on a spreadsheet of names, you let buyer behavior tell you who is ready to hear from you and when. A buyer intent signal could be a LinkedIn post complaining about a current tool, a tweet asking for recommendations, a job posting that reveals a new initiative, or engagement with competitor content.

The core principle: don't reach out because it's Tuesday and this name is on your list. Reach out because this person just showed you they have a problem you solve.

Traditional outbound treats every prospect the same regardless of where they are in their buying journey. Signal-driven outbound recognizes that the same person who ignores your message in January might be desperate for your solution in March — if you catch them at the right moment. As Chris Walker, CEO of Passetto and a leading voice on signal-based GTM strategy, puts it: outbound should be built on signals, not spreadsheets.

Why Traditional Outbound is Broken

Traditional outbound is any sales motion where outreach is triggered by a schedule or list rather than buyer behavior. In 2026, this model is failing because of volume saturation, poor targeting, and a fundamental misunderstanding of what drives response rates.

The Volume Trap

The average B2B decision-maker receives over 120 emails per day. Over 375 billion emails are sent globally every day, a number projected to reach 396 billion by the end of 2026. LinkedIn inboxes are flooded with connection requests followed by immediate pitches. The response to declining reply rates has been to send more. More emails. More sequences. More touchpoints. And it's making the problem worse.

According to the Salesforce State of Sales report (6th Edition, 2024), sellers spend just 30% of their time actually selling. The rest goes to admin, research, and outreach that produces nothing. Cold email response rates have dropped from 8.5% in 2019 to just 4.0% in 2025 — more than halved in six years. The volume approach worked when inboxes were less crowded. In 2026, it's a race to the bottom.

The Targeting Problem

Even companies with sophisticated ideal customer profiles (ICPs) face the same fundamental issue: matching a demographic profile doesn't mean someone is ready to buy. A VP of Sales at a 200-person SaaS company might be your perfect customer on paper. But if they signed a 3-year contract with a competitor last month, no amount of clever copywriting will get a meeting.

Static lists capture who someone is. They tell you nothing about where that person is in their buying journey right now. This is the difference between firmographic data and intent data — and it's the difference between spray-and-pray and signal-driven outreach.

The Messaging Obsession

Sales teams spend enormous energy on messaging. A/B testing subject lines. Workshopping opening lines. Testing different CTAs. And while messaging matters, it's optimizing the wrong variable.

A mediocre message sent at the perfect moment outperforms a brilliant message sent at the wrong time. Every time.

Think about your own behavior. If you're actively frustrated with a tool and someone offers an alternative, you'll read a message with a typo in it. If you're not looking for anything, the most polished pitch in the world gets archived. Research backs this up: 71% of B2B decision-makers ignore emails that don't address their specific, current needs.

The Spray-and-Pray Economics

Here's the math on traditional outbound versus signal-driven outbound:

| Metric | Traditional Outbound | Signal-Driven Outbound |

|---|---|---|

| Outreach sent per month | 10,000+ | 500-2,000 |

| Average reply rate | 3-4% (Belkins, 2025) | 15-30% |

| Positive reply rate | 0.5-1% | 5-15% |

| Meetings booked | 50-100 | 50-200 |

| Cost per meeting (with SDR) | $500-1,000 | $50-200 |

Less volume. Better results. Lower cost. That's the economics of timing.

The Science of Timing in B2B Sales

Outbound sales timing refers to the practice of aligning your outreach with the prospect's buying window — the period when they are actively evaluating solutions. Research consistently shows that timing is the single most impactful variable in outbound success, outweighing messaging, channel choice, and even offer quality.

The Buying Window

B2B purchasing decisions unfold over an average of 10.1 months according to Corporate Visions' 2025 research, though technology purchases are faster: 38% close within 1-3 months and 34% within 3-6 months. Within that cycle, there's a critical window — typically 2-6 weeks — when a buyer moves from passive awareness to active evaluation.

During this window, buyers are receptive to outreach. Outside of it, they're not. Traditional outbound has no way of knowing when this window opens, so messages are sent on a schedule with roughly a 5-10% chance of coinciding with the active buying phase. Signal-driven outbound detects the window opening in real time.

There's a new trend making this even more urgent: 49% of buyers say economic conditions have shortened their buying cycles, and 62% say they're engaging sellers earlier in the process. The point of first contact has moved from 69% through the journey to 61% — pulling the engagement window forward by roughly 6-7 weeks. Buyers are ready sooner, and the teams that detect this shift first win.

First-Mover Advantage

The 6sense 2025 Buyer Experience Report, surveying over 4,000 B2B buyers, found that the vendor buyers contact first wins the deal approximately 80% of the time. Even more striking: 95% of the time, the winning vendor is already on the buyer's "Day One shortlist" — the mental list of vendors a buyer considers before they ever reach out to sales.

This means two things for signal-driven outbound. First, being the first to respond to a buying signal gives you an overwhelming advantage. When a founder tweets about needing better outreach tools, the company that responds within hours is likely the one that gets the meeting. Second, the awareness you build before the buying window opens matters enormously. The Engagement Engine approach — building social presence through likes, comments, and genuine interaction before outreach — is what gets you on that Day One shortlist.

The Decay Curve of Intent

Buyer intent isn't permanent. It decays. Someone who posts about a pain point today is most receptive to solutions today and tomorrow. By next week, they've either found something or moved on to other priorities.

This is why speed matters as much as accuracy in signal-driven outbound. Detecting a signal 48 hours after it appeared is dramatically less valuable than detecting it within minutes. The ideal system surfaces buyers within minutes of intent appearing and triggers engagement immediately.

What Are Buyer Intent Signals?

Buyer intent signals are observable actions or behaviors that indicate a person or company is moving toward a purchase decision. In B2B sales, these signals fall into three categories, each with different levels of strength and urgency. Understanding these categories is essential for effective lead generation across platforms.

1. Pain Point Signals (Strongest)

Pain point signals are the most actionable type of buyer intent signal. They occur when a prospect explicitly expresses frustration with a problem your product solves.

Examples on LinkedIn:

- Posts complaining about current tools or processes

- Comments describing struggles with a specific workflow

- Articles published about challenges in their role or department

Examples on X:

- Tweets expressing frustration with their current stack

- Replies to threads about common industry pain points

- Threads about failed experiments with existing solutions

A marketing VP tweeting "We've been using [competitor] for 6 months and I'm losing my mind. The reporting is useless." is a pain point signal with a flashing neon sign. This person is primed for a conversation about alternatives.

2. Buying Signals (High Intent)

Buying signals indicate someone is actively evaluating solutions. They haven't committed yet and they're gathering information. These are the signals that traditional automation tools miss entirely because they require real-time monitoring, not list building.

Examples on LinkedIn:

- Posting "any recommendations for..." questions

- Engaging with product comparison content

- Connecting with multiple sales reps from competitor companies

Examples on X:

- Asking followers for tool recommendations

- Engaging with product launch announcements in your space

- Bookmarking or retweeting competitor comparison threads

3. Contextual Signals (Supporting)

Contextual signals are indirect indicators that create conditions favorable for a purchase. They don't confirm intent on their own, but they're powerful when combined with other signal types.

Examples include:

- Executive hires — New leadership often means new tools and processes

- Funding announcements — Budget gets unlocked after a raise

- Growth signals — Hiring SDRs signals investment in outreach capacity

- Job postings — Listings mentioning specific technologies reveal buying intent

- Organizational changes — Restructuring shifts priorities and vendor evaluations

A company that just raised a Series B, hired a Head of Sales, and posted three SDR openings is almost certainly about to invest in sales tools. Each signal alone is weak. Together, they paint a clear picture.

Where Buyer Signals Appear on LinkedIn and X

LinkedIn and X (Twitter) are the two highest-value platforms for detecting B2B buyer intent signals. Each surfaces different types of intelligence, and monitoring both provides the most complete picture of buyer readiness.

LinkedIn Signals

LinkedIn is where professionals discuss work openly. The signals tend to be more structured and career-oriented:

- Status updates about role changes, challenges, or company milestones

- Engagement patterns — Repeated interaction with competitor content, industry posts, and thought leadership

- Job postings that reveal strategic direction and technology investments

- Group discussions where buyers ask questions and share vendor experiences

- Profile changes like new titles, certifications, skills, or headline updates

The challenge with LinkedIn is that conversations happen slower and signals can be subtle. A VP quietly liking three posts about sales automation over two weeks is a signal, but you'd miss it without systematic monitoring.

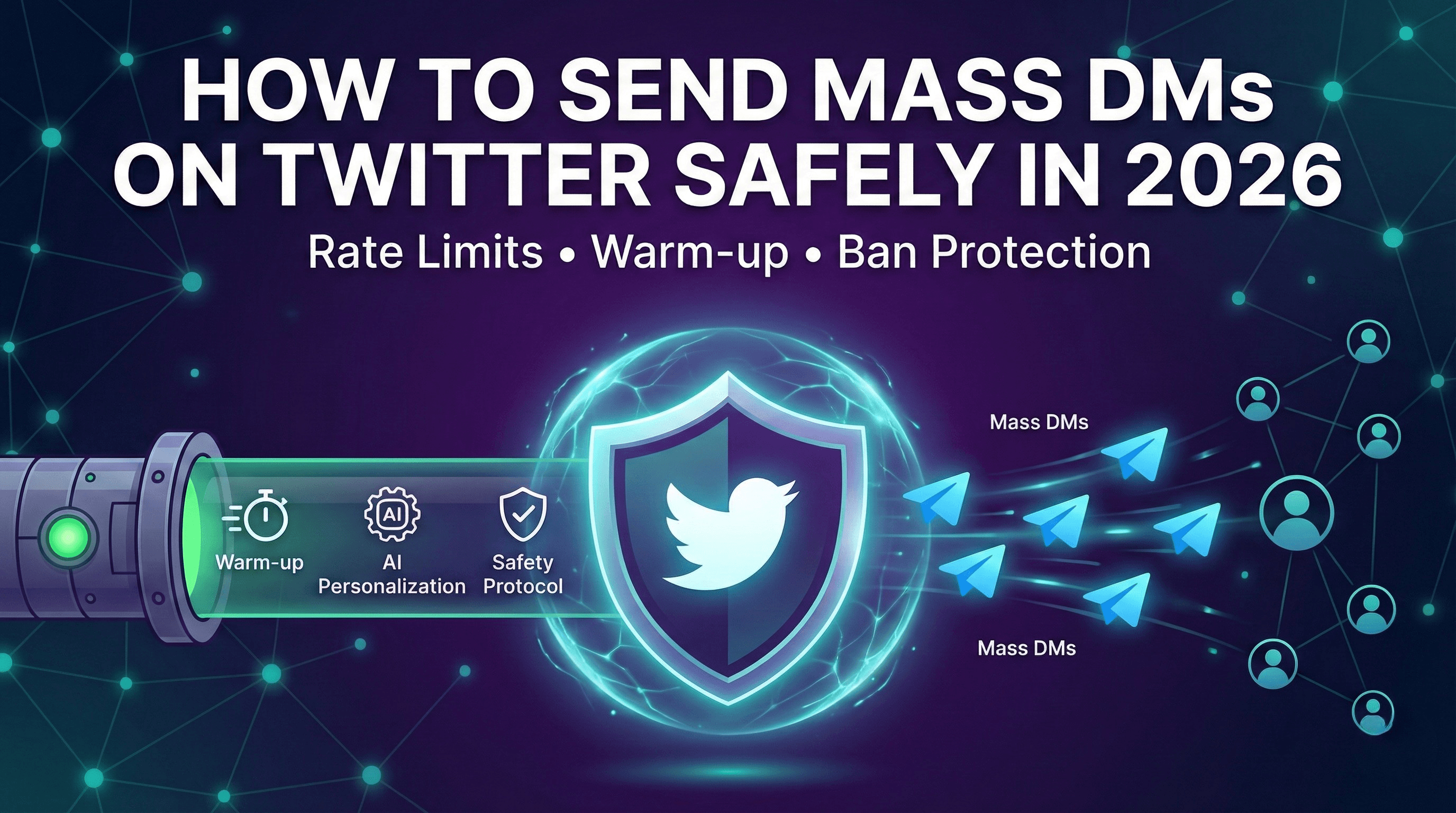

X (Twitter) Signals

X is faster, more public, and more unfiltered. Buyers say things on X they'd never post on LinkedIn:

- Direct complaints about tools, processes, or vendors

- Recommendation requests asking followers for suggestions

- Competitor mentions — both positive and negative

- Industry commentary revealing current priorities and pain points

- Real-time reactions to news, product launches, and market changes

X signals are higher urgency because the platform moves fast. A tweet asking "anyone have a good alternative to [tool]?" has a shelf life of hours, not days. This is why automated DM outreach paired with signal detection produces dramatically better results than cold messaging.

The Cross-Platform Advantage

The most complete picture of buyer intent comes from monitoring both platforms simultaneously. A prospect might post a thoughtful LinkedIn article about their outreach challenges on Monday and tweet a frustrated rant about the same problem on Thursday. Together, these signals confirm strong intent. Individually, either might be noise.

This is why cross-platform signal detection is becoming essential for B2B sales teams. The companies that see the full picture across LinkedIn and X have a structural advantage over those monitoring only one channel.

How Signal-Driven Outbound Works in Practice

Signal-driven outbound follows a five-step workflow: define signal criteria, monitor continuously, score and prioritize, engage at the right moment, and let AI handle the conversation through to a booked meeting.

Step 1: Define Your Signal Criteria

Before detecting signals, define what you're looking for:

- Pain point keywords — Words buyers use when frustrated with the problem you solve

- Buying keywords — Language used when actively evaluating solutions ("looking for", "recommendations for", "alternative to")

- Competitor mentions — Specific competitor names and products that should trigger alerts

- Contextual triggers — Company events that create buying conditions (funding, hiring, leadership changes)

Be specific. "Looking for a better outreach tool" is a signal. "Using technology" is not. The more precise your criteria, the higher quality your detected signals will be.

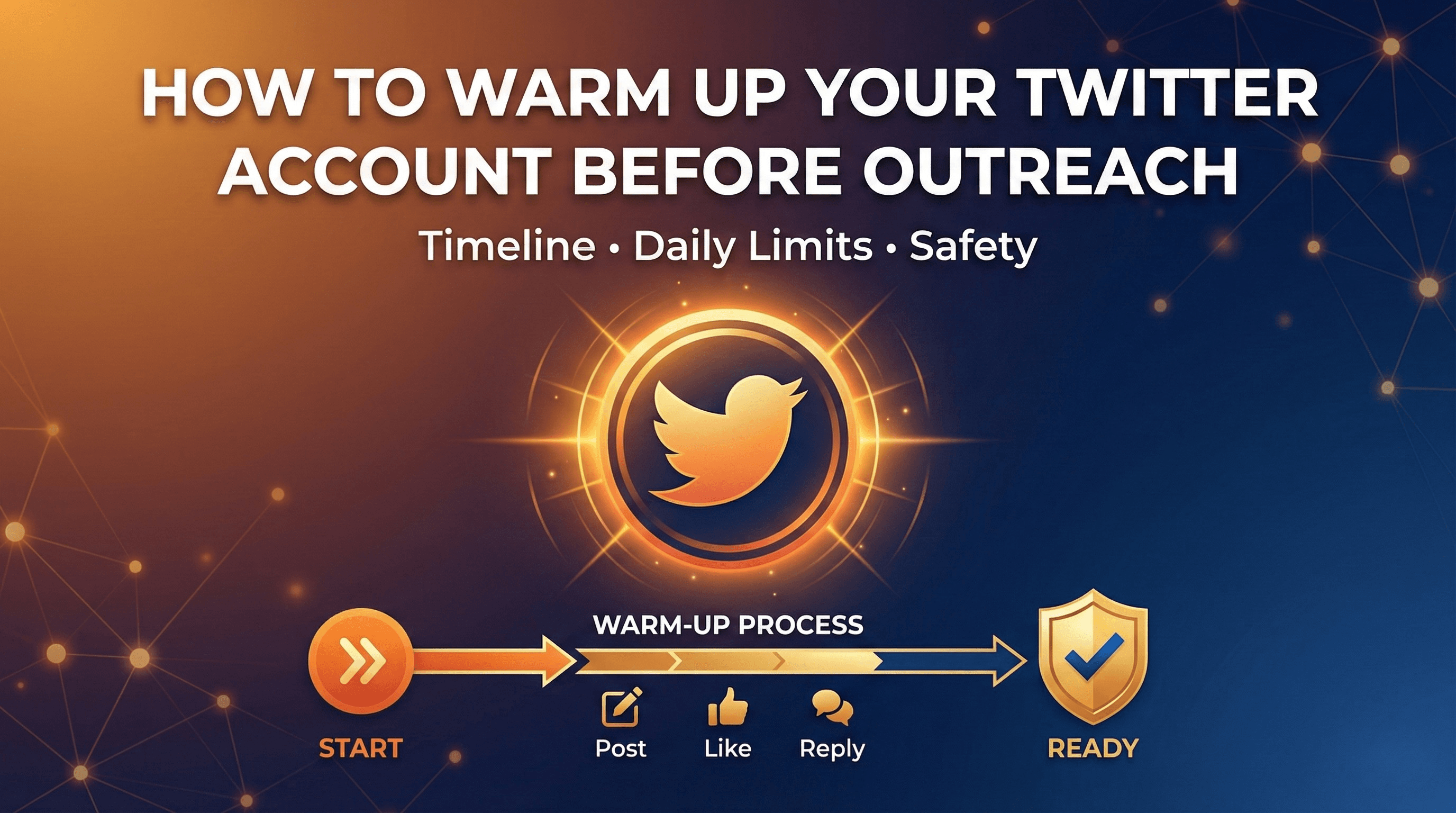

Step 2: Monitor Continuously

Signal detection must run 24/7. Buyer intent doesn't follow a 9-to-5 schedule. A prospect might tweet at 11 PM or post on LinkedIn over the weekend. Q1 is the peak buying window — 22 of 27 B2B categories see highest activity in January or March.

Modern AI-powered systems scan both LinkedIn and X continuously, classifying posts in real time as pain points, buying signals, or competitor mentions. Each detected signal includes the prospect's profile data and a priority score based on signal strength and recency.

Step 3: Score and Prioritize

Not all signals deserve the same response. A direct recommendation request from a funded startup founder is worth far more than a vague industry comment from an intern. Effective scoring evaluates three dimensions:

- Fit — How closely the person matches your ideal customer profile

- Intent — How strong and explicit the buying signal is

- Timing — How recent the signal is and whether multiple signals are converging

The combination of fit, intent, and timing produces a composite buyer score that tells you exactly who to prioritize and who to skip.

Step 4: Engage at the Right Moment

When a high-priority signal appears, outreach begins immediately — but not with a cold pitch. The engagement approach depends on the platform:

For X signals:

- Engage with the signal post (like, thoughtful reply)

- Interact with their recent content to build familiarity

- Send a personalized DM that references the specific signal

- Handle the conversation and guide toward a meeting

For LinkedIn signals:

- Connect with a contextual note referencing what they posted

- Engage with their content to become a familiar name

- Send a message that addresses their specific pain point

- Continue the conversation across platforms if needed

For cross-platform sequences:

- Detect the signal on whichever platform it appeared

- Engage on that platform first

- Extend to the other platform for additional touchpoints

- Consolidate everything in a unified inbox

Step 5: Let AI Handle the Conversation

Once contact is made, AI manages the back-and-forth autonomously. Because you already know what problem the prospect is experiencing — the signal told you — the AI can address their specific situation rather than running a generic pitch.

This is fundamentally different from traditional AI outreach that opens with "Hi, I noticed you're a VP of Sales at a growing company..." Signal-driven AI opens with "I saw your post about struggling with reply rates on cold outreach — we've been solving exactly that..." The conversation is relevant from the first message because the outreach was triggered by a real signal, not a list.

The AI handles objections, qualifies the prospect, builds rapport, and books the meeting directly to your calendar. No human intervention needed for the standard flow.

Signal-Driven vs. List-Based Outbound: A Comparison

This table compares traditional list-based outbound with signal-driven outbound across every key dimension:

| Factor | List-Based Outbound | Signal-Driven Outbound |

|---|---|---|

| Targeting basis | Demographics and firmographics | Real-time behavior and intent signals |

| Timing | Scheduled cadences (hope-based) | Triggered by buyer activity |

| Personalization | Template + merge fields | Contextual to the specific signal detected |

| Volume | High (10,000+ per month) | Focused (500-2,000 per month) |

| Reply rates | 3-4% average (Belkins, 2025) | 15-30% |

| Positive reply rates | 0.5-1% | 5-15% |

| Meetings booked per 1,000 outreach | 5-10 | 50-150 |

| Sales cycle length | Longer (educating unaware buyers) | Shorter (engaging buyers already in-market) |

| Account safety | Higher risk (bulk messaging patterns) | Lower risk (natural engagement patterns) |

| Platforms | Usually email or LinkedIn only | Cross-platform (LinkedIn + X) |

| Cost per meeting | $500-1,000 | $50-200 |

| Conversion improvement | Baseline | 36% higher conversion (Forrester, 2025) |

Signal-driven outbound produces dramatically better results at lower volume. You're not working harder. You're reaching the right person at the right moment.

How to Build a Signal-Driven Outbound System

There are three approaches to implementing signal-driven outbound, ranging from manual to fully automated.

Option 1: Manual Signal Detection

You can start signal-driven outbound with no tools. It validates the approach but doesn't scale.

- Set up X keyword searches for your pain point and buying terms

- Check LinkedIn for relevant posts daily

- Track signals in a spreadsheet with source, date, and priority

- Respond manually when you spot a signal

- Follow up through DMs or messages

This caps at roughly 10-20 signals per day and you'll miss most opportunities because you can't monitor continuously. But it proves the concept and teaches you which signals matter in your market.

Option 2: Cobbled-Together Tool Stack

Many teams try assembling signal detection from existing tools:

- Google Alerts for brand and keyword monitoring

- LinkedIn Sales Navigator for saved searches

- Twitter lists and TweetDeck for keyword tracking

- A CRM to log and track signals manually

- Separate enrichment tools like Clay for lead data

This improves coverage but creates a fragmented workflow with no unified view. You spend more time switching between tools than acting on signals, and there's no automated connection between signal detection and outreach execution.

Option 3: Purpose-Built Buyer Detection Platform

The most effective approach is a platform specifically designed for signal-driven outbound. Autoreach is built around this exact workflow — it is not an automation tool, it is a buyer detection system:

- Intent Streams — AI continuously monitors LinkedIn and X for pain points, competitor mentions, and buying signals, surfacing buyers within minutes of intent appearing

- Buyer Intelligence — Every lead scored across three dimensions (Fit, Intent, Timing) with a composite Buyer Score that tells you exactly who to prioritize

- Full Lead Enrichment — Automatically pulls LinkedIn profiles, X profiles, emails, company websites, and web search data. No need for separate tools like Clay

- Cross-Platform Sequences — Visual sequence builder with IF/THEN logic that spans LinkedIn and X. If a prospect doesn't reply on LinkedIn, the sequence branches to X engagement automatically

- AI Conversations — Autonomous objection handling, qualification, rapport building, and meeting booking directly to your calendar

- Unified Inbox — Every conversation across both platforms in one place, with AI mode (fully autonomous) or Manual mode (you reply yourself)

- Engagement Engine — Builds social presence through auto-likes, comments, follows, and profile views before outreach begins, getting you on the buyer's Day One shortlist

The result is a closed-loop system: detect the signal, enrich the lead, engage on the right platform, handle the conversation, book the meeting. Starting at $39/month during the beta.

Common Mistakes When Moving to Signal-Driven Outbound

1. Treating Signals Like a Lead List

The biggest mistake is detecting signals and dumping them into a traditional sequence. The whole point of signal-driven outbound is contextual outreach. If someone tweets about a specific pain point and you send them a generic product pitch, you've wasted the intelligence. Reference the signal. Address the specific problem. Make it clear why you're reaching out.

2. Monitoring Only One Platform

If you're only watching LinkedIn, you miss the raw, unfiltered complaints that happen on X. If you're only watching X, you miss the professional context and structured buying signals on LinkedIn. The full picture requires both platforms.

3. Ignoring Signal Decay

A signal from two weeks ago is not the same as a signal from two hours ago. Intent decays rapidly. If your system detects a signal but you don't act for days, you're losing most of the timing advantage that makes this approach work. Build workflows that trigger outreach within hours of detection.

4. Setting Keyword Criteria Too Broadly

"Sales" is not a useful keyword. "Our outbound reply rates have been terrible this quarter" is. The more specific your signal criteria, the higher quality your detected signals will be. Broad keywords create noise that buries real buying signals.

5. Not Scoring Signals

A direct recommendation request from a funded startup founder is worth 100x more than a vague industry comment from an intern. Without scoring by fit, intent, and timing, you'll waste effort on low-value signals while high-priority ones expire.

Key Takeaways

- Signal-driven outbound triggers outreach based on real-time buyer behavior, not static lists or fixed schedules

- Timing is the #1 variable in outbound success — a mediocre message at the right moment beats a perfect message at the wrong time

- Three signal types to monitor: pain point signals (strongest), buying signals (high intent), and contextual signals (supporting)

- Monitor both LinkedIn and X — each platform surfaces different types of buyer intelligence, and the cross-platform picture is more complete than either alone

- First-mover advantage is real: 6sense found the first-contacted vendor wins approximately 80% of the time

- Intent-based outbound delivers 36% higher conversion rates and 29% lower acquisition costs (Forrester, 2025)

- Cold email reply rates have halved from 8.5% (2019) to 4.0% (2025) — volume-based outbound is losing ground every year

- Speed matters: signals decay rapidly, so the best systems detect intent within minutes and trigger engagement immediately

- Score every signal by fit, intent, and timing to focus effort on the highest-value opportunities

Frequently Asked Questions

What is signal-driven outbound?

Signal-driven outbound is a B2B sales methodology where outreach is triggered by real-time buyer intent signals rather than static contact lists or fixed cadences. You monitor platforms like LinkedIn and X for signs that prospects are actively experiencing problems you solve, evaluating solutions, or showing readiness to buy. When a signal appears, you engage immediately with context-specific outreach. It is also called signal-based selling, warm outbound, or intent-based outreach.

How is signal-driven outbound different from traditional intent data?

Traditional intent data products like Bombora or G2 track anonymous website visits and content consumption at the company level. Signal-driven outbound detects individual buyer behavior on social platforms in real time. You're not seeing "Company X is researching CRM software." You're seeing "The VP of Sales at Company X just tweeted that their current CRM is driving them crazy." It's more specific, more actionable, and more immediate — tied to a real person, not an anonymous account.

What platforms should I monitor for buyer intent signals?

For B2B sales, LinkedIn and X (Twitter) are the two highest-value platforms. LinkedIn provides professional context including job changes, company updates, and structured buying signals. X provides raw, real-time signals including complaints, recommendation requests, and competitor mentions. Monitoring both gives you the most complete picture of buyer intent. Tools like Autoreach monitor both platforms simultaneously with unified scoring and outreach.

How quickly do I need to act on a buyer signal?

Speed is critical. Intent decays over time — a signal acted on within hours produces dramatically better results than one acted on days later. The 6sense 2025 Buyer Experience Report found that the first vendor to engage wins approximately 80% of deals. The ideal system detects signals within minutes and triggers engagement immediately, not days later.

What types of buyer intent signals should I look for?

The three main categories are: pain point signals (prospects expressing frustration with problems you solve — the strongest type), buying signals (prospects actively evaluating solutions or asking for recommendations), and contextual signals (company events like funding rounds, executive hires, or job postings that create buying conditions). Multiple signal types from the same prospect indicate the highest intent and should be prioritized.

What tools are used for buyer intent signal detection?

The buyer intent data market is valued at approximately $4.5 billion in 2026. Enterprise intent data platforms include 6sense, Demandbase, Bombora, and ZoomInfo. For social signal detection across LinkedIn and X specifically, Autoreach provides real-time Intent Streams that detect pain points, competitor mentions, and buying signals, with AI scoring and automated cross-platform outreach starting at $39/month.

How does signal-driven outbound affect reply rates?

Businesses using intent-based outbound report 36% improved conversion rates compared to non-intent-based campaigns (Forrester, 2025). On the outreach side, signal-driven teams consistently see 15-30% reply rates compared to the 3-4% average for traditional cold outbound (Belkins, 2025). The improvement comes from reaching people who have an active, current need at the moment that need is top of mind.

Does signal-driven outbound work for any B2B industry?

Signal-driven outbound works best in B2B markets where buyers discuss problems, evaluate tools, and make purchasing decisions with some public visibility on LinkedIn or X. SaaS, professional services, agencies, and technology companies see the strongest results because their buyers are active on these platforms. Industries with less social visibility may see fewer signals, but the core principle still applies: timing outperforms volume in every market.

Stop Guessing. Start Detecting.

The future of outbound isn't better copy. It isn't more emails. It isn't another A/B test on your subject line. Cold email reply rates have been cut in half over six years. The spray-and-pray era is ending.

Signal-driven outbound is the shift from hoping to knowing. From scheduled cadences to triggered engagement. From spray-and-pray to detect-and-respond. The companies that detect buyers first win the meetings. The ones still blasting lists are competing for what's left.

As Latane Conant, CRO of 6sense and author of No Forms. No Spam. No Cold Calls, has argued: the future of B2B sales belongs to teams that eliminate cold outreach entirely and replace it with signal-driven engagement. The data backs this up. The technology exists. The question is whether you adopt it before or after your competitors do.

Ready to see what signal-driven outbound looks like in practice?

Try Autoreach — the AI Buyer Engine that detects buying signals on LinkedIn and X in real time, scores every lead by fit, intent, and timing, runs cross-platform sequences, handles conversations autonomously, and books meetings to your calendar. All on autopilot, starting at $39/month.

Tags

Ready to automate your outreach?

Start generating leads on X with AI-powered automation.